“I can now focus less on fixing reports and focus more on strategic initiatives to help grow the company.“

Jack Barnett

Strategy Manager

Founded in 2021, Sunstone Credit has pioneered how businesses adopt renewable energy through accessible solar financing. Its proprietary technology platform enables customers to easily access simple, affordable, and easy-to-understand solar loan products with flexible terms and a streamlined application process.

Like many other financial organizations, Sunstone’s business model relies heavily on reliable data and analytics. Processes such as loan operations, financial operations, underwriting, and account management strategy depend on accurate and fresh data.

The Strategy team at Sunstone Credit quickly found that as the business grew, keeping track of high-volume information in Microsoft Excel wasn’t simple. Creating recurring and on-request metrics for analysis or marketing required multiple days of manual processing, leaving reports highly prone to inaccuracies and errors.

Jack Barnett, Strategy Manager, and his team quickly realized that if the business was to manage the data needed to keep decision-makers from Financial Operations to Loan Operations up-to-date with the latest loan information, it required a single source of truth for reports.

“Our company was facing difficulties related to data and reporting on a number of fronts. The biggest issue was a lack of a single source of truth to drive company-wide analysis off of that was both easily refreshable and distributable to the broader company. In addition, we had key daily loan servicing data sitting in Excel files with no way automated way to pull the data and create related reporting. It also provides better controls for data permissions, which is a key concern given the many compliance issues inherent to a financing business.”

The team needed a single source of truth to help ensure that loan, finance, and operational data were accurate, up-to-date, and accessible across the organization. To comply with SOC 2 compliance, security permission controls needed to be enforced to restrict access to Personally Identifiable Information (PII).

Given the business’s complex loan application workflow, the Sunstone Credit team needed support from specialized data tools. Every checkpoint of the loan workflow needs to be a trackable metric.

Capturing every historic data point required Sunstone to manually export all of its data into various sheets in Excel. The team would then add a layer of complex calculations and functions to create its metrics. Altering the logic required updating the calculations on all impacted fields, which was time-consuming.

Fortunately, Velocity Sense significantly assisted the team in managing this complexity. Designing a modular data architecture reduced masses of complex loan application logic into more manageable, maintainable layers. By breaking down intricate processes and data flows into simpler components, the team no longer needed to maintain data in Excel and relied solely on its data warehouse.

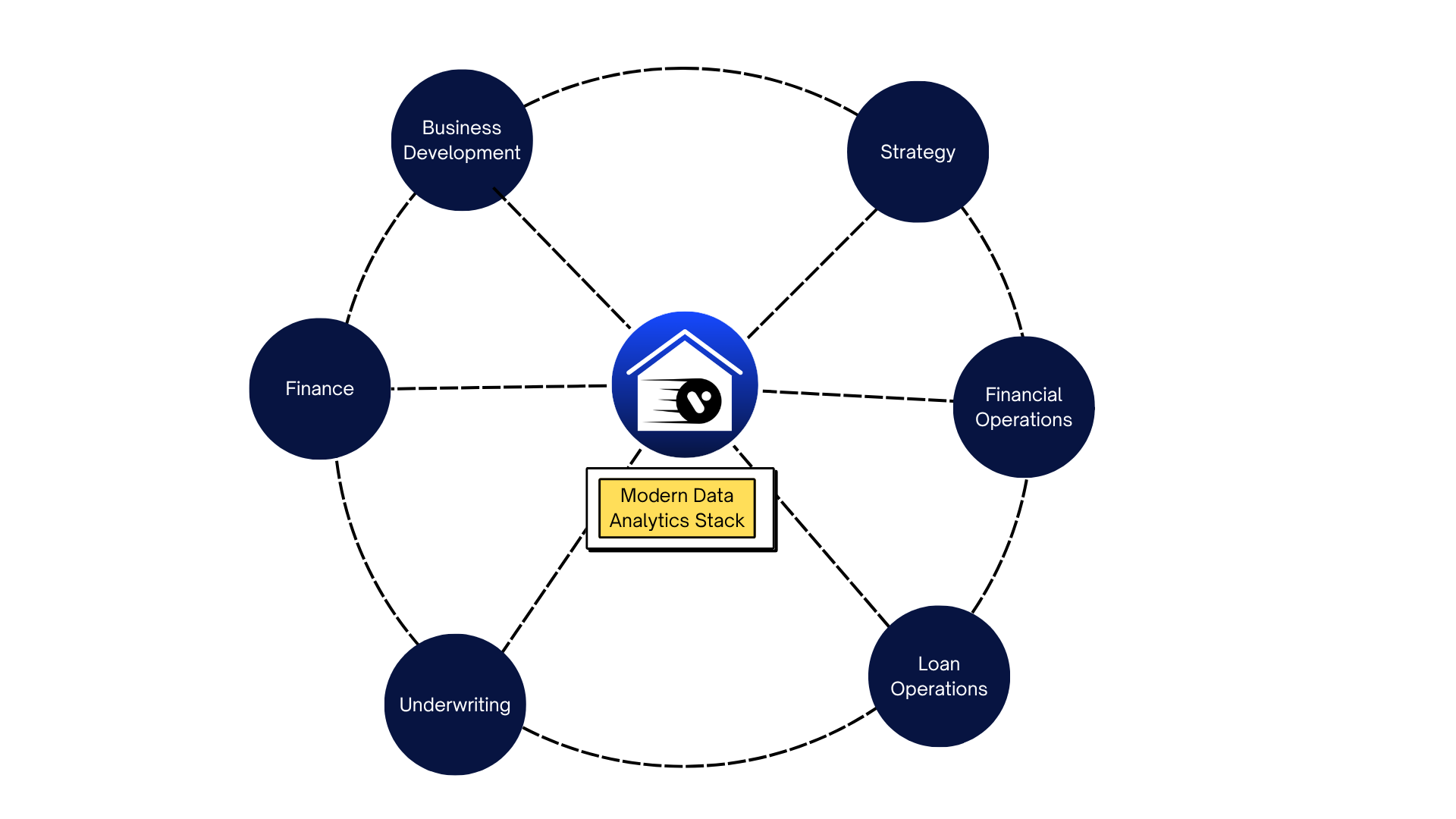

We rethought how Sunstone used its data to create a modern data analytics stack that solved reporting needs across 6 divisions. Introducing a modern data analytics stack sped up the team’s reporting needs, enabled conversations with AI to produce reports, and provided a single source of truth to power all of its reports.

“Updating our data infrastructure to a scalable solution has provided an immediate, substantial impact across the business. Operating employees and management alike have accurate visibility into the data that matters to them, reducing reporting friction and saving time across the company on a daily basis.”

The modern data analytics stack consisted of a suite of advanced data tools using:

Introducing a modern data analytics stack has transformed Sunstone Credit’s decision-making and unlocked cross-team alignment. Its benefits became immediately apparent.

Its portfolio of installers grew by 60% by smartly allocating resources to process those installers with the highest ROI.

The greater visibility of centralized data also significantly improved communications among teams. Teams can now self-serve reports using the same data source, minimizing inconsistencies and reducing the time it takes to modify data and create critical presentation materials.

“The project helps me as a Strategy Manager to minimize the amount of time I need to spend updating reports and correcting bad data, allowing me to focus on more strategic initiatives to help grow the company.

For other employees around Sunstone, it has given them access to near real-time reporting, saving multiple hours per week for key operating personnel across and allowing them to do their jobs easier.”

Sunstone teams are now more aware of the impacts of their decisions, such as information related to funding loans. Integration of partner data enabled not only a monthly view but now at a daily granularity of loan tape.

The handoff to Sunstone was a complete transition. Sunstone’s in-house engineering team received comprehensive documentation and completed workshops facilitated by Velocity Sense to fully maintain and build upon its new modern data analytics stack.

Looking ahead, the Sunstone engineering team is building on the scalable foundation to implement advanced analytics across the business as changes are made to existing loan workflows are released.

The downstream impacts create a rippling effect. Sunstone’s customers save money, reduce its carbon footprint, and drive a clean, green future for all.

Financial Services

New York, NY

Series A

Snowflake, dbt, Fivetran, Salesforce, Postgres, AWS, Docker

Sunstone Credit helps businesses save money and reduce their carbon footprint by going solar through its best-in-class technology platform. Its solar projects include office buildings, retail, wineries, dealerships and many more.

Book a free 30-minute call with us to discover we can help solve your data problems.

At Velocity Sense, we’re hyper-focused in building tailored marketing data platforms for agencies and teams. Our deep expertise in Data Engineering for the Marketing sector means we just “get it”. We architect platforms that transform your data into actionable marketing strategies, helping you increase LTV, boost conversions, reduce acquisition costs, and gain a deeper understanding of your customers.

We use cookies to enhance your browsing experience, analyze site traffic, and personalize content for our marketing clients. By clicking "Accept", you agree to our use of cookies. To learn more about our cookie policies, click "Cookie Policy".